The trade impasse between the United States and China is finally impacting the running market.

Here is a summary of the latest back and forth developments on the subject. Keep in mind that the situation is very fluid and is changing hourly.

- The two countries with the largest economies in the world have been negotiating over what U.S. companies see as flagrant intellectual property theft by Chinese companies and regulations that force U.S. companies to transfer technology to Chinese firms.

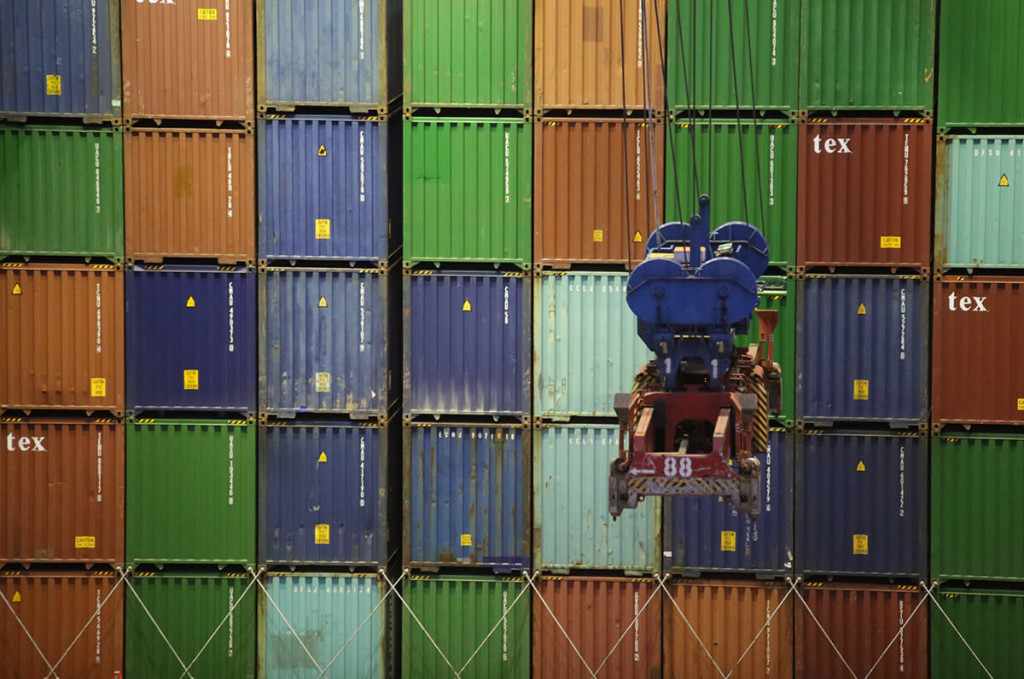

- While those are the two key issues, the battle is being fought over tariffs imposed by President Donald Trump on goods imported from China. To date most of the tariffs have been imposed on industrial products such as steel, but the most recent set of tariffs announced last week are striking closer to home in the sporting goods industry, hitting categories such as hats, gloves and components for fitness gear.

- And if the next round of tariffs that President Trump has threatened in e-mails, set at 25 percent, take effect, prices on athletic footwear made in China are sure to rise. Meanwhile, in response to that, China has said it will increase tariffs on $60 billion worth of goods made in America and shipped to China.

Important tariffs are paid by American companies at the border on goods they import from China. If a company faces increased tariffs, they can pay and impact their bottom line, or raise prices to retailers and ultimately consumers to defray the costs of increased tariffs.

“While we welcome the administration’s tough position on intellectual property protection and transfer of technology, the tariffs present a problem for our industry,” says Tom Cove, president and CEO of the Sports & Fitness Industry Association.

Cove and others in the know say that the tariffs will inevitably result in higher prices for American consumers. Meanwhile, on the supply chain front American brands are scrambling to move production out of China to other countries.

“Companies have been diversifying out of China for the past 10 years,” says Steve Lamar, EVP of the American Apparel & Footwear Association. “Nike led the way and others have followed.”

The Vietnam Story

Lamar says that Vietnam has been “the story” for the past couple of years as companies diversify out of China, so much in fact that factories in that country are near capacity, which could limit future growth. Indonesia and Cambodia are the two countries most likely to take on production from athletic footwear companies that leave China.

“It’s like bumper cars,” Lamar says. “Production is being bumped from one factory and one country to another. This is the biggest sourcing disruption we’ve seen in a generation.”

Lamar says the next round of proposed tariffs, which would increase rates on athletic footwear from China by 25 percent, would take effect in approximately 80 days. “There is a process,” he says. “It needs to be posted, there will be hearings and lobbying. If it happens, the tariffs would go into effect by the end of July.”

While many fear price increases and sourcing disruptions, other are hoping that cooler heads will ultimately prevail.

Said one executive experienced in athletic footwear sourcing in China: “Right now, there is a lot of posturing on both sides. Trump is trying to convey to the Chinese that they cannot expect business as usual where they agree to terms and then do whatever they want. This situation will not be resolved easily or quickly.”

Brooks Pulling Production from China

The leading running shoe brand has had it with the uncertainty over production in China.

Brooks CEO Jim Weber told Running Insight last week that the brand plans to remove all production from China by the end of the year, moving most of it to Vietnam. In fact, Weber says its longtime partners in China have already begun construction on new factories in Vietnam to accommodate the shift in production.

“It’s been an escalating journey with our production,” Weber said. “We’ve always engaged in alternatives planning and now it’s time to put those plans in place.”

Weber said that last year 45 percent of the brand’s shoes were made in China, with Vietnamese factories accounting for most of the rest. Brooks has sourced in Vietnam for about five years, Weber said.

In 2018, Brooks paid $19 million in duties on shoes imported from China based on a duty rate of 20 percent, the company said.

If the tariff goes up 25 percent as President Trump has threatened, Brooks will pay 45 percent on Run footwear out of China, which would result in additional tariffs of $23 million in 2019 or $42 million total on the same import volume as 2018. Brooks said it would pay $47 million assuming there’s a 10 percent volume increase in 2019.

Weber said the factories Brooks uses in China and Vietnam employ about 18,000 people and Brooks itself employs about 50 in Asia, including a leadership team to manage production flow and quality control.

Weber said Brooks has long-term relationships in Asia and does not “make the same shoe in three different factories like some brands.” “We’ve had relationships going back 10-15 years and like to make decisions that are based on five-year plans.”